The JTR Download - July

- James Pearson

- Jul 7, 2021

- 4 min read

Capacity Crunch

The Good

We’re entering the summer slow-down – giving shippers and manufacturers a

much-needed chance to catch up to one of the craziest six months in freight history

with record volumes and incredible demand.

The Bad

The peak season is looming. And with rising fuel costs, scarce capacity, record import volumes, skyrocketing spot & contract rates already in the hopper –

let’s all buckle-up & get comfortable – it’s gonna be a wild second half.

Truckload

Southern TL capacity vanishes heading into the fourth

Rejection rates in Atlanta and Dallas have hit an all-time high as we start July.

In the beginning of June shippers and brokers were breathing a sigh of relief as

the market stabilized a bit. But heading into the second week of June, capacity

tightened to record levels at many of the nation’s largest freight centers.

In a year that’s been nothing short of mind-boggling, these new numbers are a

cause for concern. With rejection rates blowing past last year’s peaks and import shipments clearing customs averaging over 40% higher YOY all across the south,

there continues to be quite a bit of strain on carrier networks.

Looking ahead, there’s a lot of potential for capacity disruption throughout the U.S.

Seasonality is pushing rejections & rates higher

After hitting an Outbound Tender Volume of nearly 16,000 over the last week

of June, volume seems to be coming back down to earth at the start of July.

All through June, volume has been higher than at any point in 2020 except

for Thanksgiving weekend. Pretty incredible.

The sheer amount of imports coming in at every port around the country

continues to drive volume. With the west coast providing a never-ending

stream of container ships while Houston, New Orleans, Miami and Savannah

are all experiencing record levels as well.

The congestion at LA and Long Beach have now spread up to Oakland as the California coastline has become a veritable parking lot of container vessels. There does seem to

be a little relief on the horizon as consumers pare back their durable goods spending

in favor of airline trips, lodging and summer entertainment. Hopefully, slowing imports just enough so this container pile-up can finally be dealt with.

Outbound Tender Volume Index

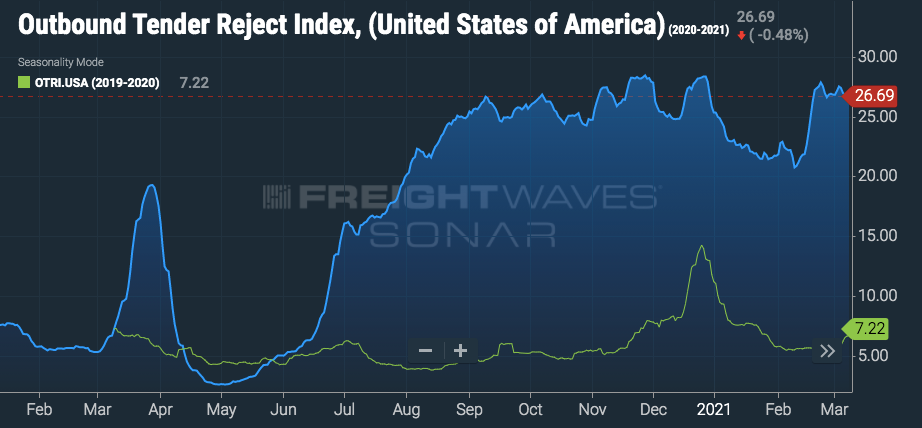

Typical for the 4th of July weekend, tender rejections have reversed course and are

on a definite uptick as drivers are only choosing loads that bring them close to home.

The OTRI now stands above 25% and rising.

Throughout June, spot rates have moderated while contract rates have pushed higher and higher. The national dry van average probably won’t hit the highs of where we

were during the winter storms, however, there’s nothing to bring them down anytime soon either. In the end, with consumers still spending, an industrial recovery humming along, plus a sizzling housing market, there’s just not enough trucks to keep up

with shipper demand.

Outbound Tender Reject Index

As summer continues, we should start seeing a convergence in spot and contract prices. But overall, rates and rejections will remain pretty elevated as demand simply

outstrips capacity.

Economy

Definitely heading in the right direction

Weekly jobless claims released this week were very promising as the labor market continues on its bumpy but stable trajectory toward recovery.

Jobless Claims. First-time unemployment filings continue to decline but we’re still double where we were before the pandemic. The big news this week was the June

Jobs Report clearly showing payrolls have surged and wages are climbing.

Employers added over 850,000 new jobs this month as companies scramble to

meet consumer demand for products and services. Economists believe there’s still

much to do to mend the post-pandemic economy and want to keep policies that

stoke demand and pave the way for a faster, fuller recovery.

Consumer Spending. Total card spending as measured by Bank of America has accelerated to 22% - the highest it’s been since 2019. The usual pre-pandemic growth rate was just 8%. So, to put it in simple terms: People are buying big-time.

Spending on services such as restaurants and movies was also way above 2019 levels,

as was money spent on wardrobe, travel and vacations.

There’s no doubt, leisure spending is on the rise and durable goods are flattening.

Manufacturing. Heading into July, regional manufacturing surveys have reported pretty positive numbers amid some ongoing logistical challenges.

Delivery times have lengthened to new record times while orders and shipments

fell a bit. Inventories continue to dwindle but overall, the manufacturing sector

seems to be finding ways to handle their supply chain and transportation challenges.

But record long lead-times, wide-scale shortages of basic materials, rising commodity prices and shipping difficulties continue to affect all segments of our manufacturing economy. The saving grace: Demand remains strong.

The Road Ahead

Trucking jobs finally show strong growth

After months of tepid stops and starts, the push to bring on more truck drivers

is starting to yield some big results. In the June employment report released this

past Friday, seasonally adjusted transportation jobs rose by nearly 6,500 up

to a total of 1,486,500.

However, economists are starting to caution that seasonally adjusted numbers may

not be that reliable after the pandemic. With that in mind, the unadjusted numbers

are even more eye-popping – with over 24,500 trucking jobs added in June alone.

Overall, carriers are seeing the strong application numbers they used to get

pre-Covid with a big upward turn predicted for the rest of summer and fall.

Historic increases in pay as well as a rise in recruiting efforts are finally paying

off and the industry hopes more drivers means more capacity.

The sooner the better, we say.

Insights

Weekly Fuel Report – 06 July 2021

Fuel prices are definitely ticking upwards adding to shipping costs that are only

going to grow as we head into the second half of 2021.

US fossil fuel consumption lowest in over 30 years

Last year marked the largest one-year decrease in U.S. fossil fuel consumption since before 1950. Economic responses to the pandemic, a relatively warm winter, and

many other factors contributed to the huge change in usage. But there’s no doubt

that Americans are changing the way they power their lives.

The one sector that drove much of the decline in energy consumption

was the transportation industry.

With a 15% decrease in fossil fuel usage, trucking, shipping and other modes

made up the biggest decrease particularly with petroleum and natural gas.

Simplicity by the truckload

We’re exclusive agents for the Digital Freight Marketplace at Emerge.

Let JTR build you a dedicated network of carriers you can rely on.

We’re talking reliable capacity and lower costs, guaranteed.

Get ship done - 855.754.0039 - Jtrlogistics.com

Source: FreightWaves.com Tuesday, July 6, 2021. https://www.freightwaves.com/truckload

Comments